The role of credit history in securing a business loan is undeniably crucial, especially in the personal lending business. The credit history of a borrower holds significant weight and acts as a determining factor for lenders to evaluate the risk associated with lending funds to that individual.

When it comes to personal lending business, where lenders provide loans based on personal creditworthiness, credit history becomes the primary indicator of an individual’s ability to repay borrowed funds. This includes not only personal loans but also business loans, as lenders often take into account the credit history of small business owners when considering loan applications.

Credit history reflects an individual’s past borrowing and repayment behavior. It showcases their debt management skills, how promptly they make payments, and whether they have a habit of defaulting. Lenders view a positive credit history as a clear indication of a borrower’s willingness and ability to repay the loan, making them a low-risk applicant.

A strong credit history enables businesses to secure loans at favorable terms, including lower interest rates, higher loan amounts, and longer repayment periods. On the other hand, a poor credit history can severely limit borrowing options or result in exorbitant interest rates and stricter lending terms. Hence, businesses with a weak credit history may find it challenging to secure loans entirely.

Building a favorable credit history is essential for any business owner seeking financial assistance. This can be accomplished by consistently making timely payments on personal and business loans, credit cards, and other financial obligations. Additionally, keeping credit utilization low and avoiding excessive debt can greatly enhance one’s creditworthiness.

Lenders typically evaluate credit history through credit reports obtained from credit bureaus. These reports compile detailed information about an individual’s borrowing habits, including outstanding balances, payment history, and any past delinquencies or bankruptcies. It is important for business owners to regularly review their credit reports for inaccuracies or discrepancies to ensure accurate evaluation by lenders.

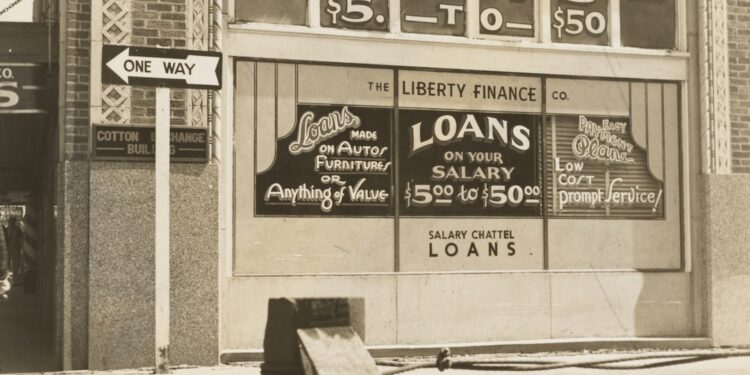

For business owners with limited credit history or a negative credit record, alternative options may exist. Some lenders offer loans specifically tailored for individuals with poor credit, although such loans often come with higher interest rates or stricter terms. Additionally, collateral-based loans, where assets like property or equipment are pledged as security, can provide a means for businesses to obtain financing even with less-than-perfect credit.

In conclusion, credit history plays a fundamental role in securing a business loan, especially in the personal lending business. Lenders rely on credit history to assess the risk associated with lending funds to individuals, including small business owners. A positive credit history enhances borrowing options, while a poor credit history can limit opportunities and lead to unfavorable lending terms. Therefore, maintaining a strong credit history is essential for business owners to secure loans at favorable terms and grow their enterprises successfully.

Publisher Details:

JCG Capital LLC

https://www.jcgbusinesslending.com/

Are you tired of traditional loan processes? Looking for a smarter, faster way to fund your business dreams? Look no further. Experience the future of lending with jcgbusinesslending.com. Get ready to revolutionize your business financing journey.